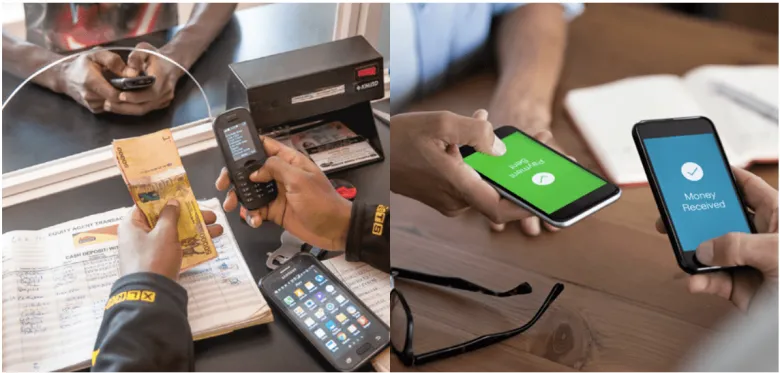

The Federal Government of Nigeria has officially begun implementing the N50 Electronic Money Transfer Levy (EMTL) on transactions exceeding N10,000 for users of fintech platforms like Opay, Moniepoint, Palmpay, and others. Introduced under the Finance Act of 2020, this levy applies to any transfer or receipt above N10,000, with a one-off N50 charge deducted by fintech companies.

Though originally scheduled to take effect on September 9, 2024, the levy’s implementation was delayed for reasons not disclosed. However, fintech companies, including Opay, Moniepoint, and Palmpay, have now confirmed that the levy will begin on December 1, 2024.

In a notice to customers on Saturday, Moniepoint confirmed the start of the N50 EMTL deduction, clarifying that the levy would be remitted directly to the Federal Inland Revenue Service (FIRS). "Dear customer, you will be charged a stamp duty of N50 on inflows of N10,000 and above. Moniepoint collects and remits this on behalf of FIRS," the message read.

Opay also informed its users on the same day via its app, stating that the EMTL charge would be applicable starting December 1, 2024. “Dear customer, in line with FIRS regulations, the EMTL applies starting from December 1st, 2024,” the notification said.

With the implementation of the EMTL, fintech companies are now required to deduct and remit the N50 levy on qualifying transactions to the FIRS. This new levy, previously only applicable to commercial banks, marks the end of the era of fee-free transactions on many fintech platforms.